Bitcoin Growth in India after Demonetization

In a bid to fight black money issues and terrorism, on November 8, 2016, Prime Minister of India shocked the nation by introducing demonetization, a move to demonetize Rs. 500 and Rs. 1000 banknotes – wiping out 86% of country’s cash in circulation overnight.

Image Source: goo.gl/1BYrg3

The Indian government has been pushing the country towards a cashless economy since it took charge in 2014. There have been various schemes for people to embrace ‘digital India’. For instance, making sure every Indian has a bank account and an Aadhar card (national security number) is their priority.

According to a study by PricewaterhouseCoopers‘, India’s unbanked population has more than halved to 233 million in 2015 from 557 million in 2011. Although, nearly 40% of the new accounts opened under government’s new scheme still carry zero balance. That said, 233 million is still a huge number.

Demonetization lead people to start exploring digital currencies and other cashless mechanisms such as internet banking, digital wallets, credit cards etc. India is a country where 87% of transactions are done in cash, but things have gradually started to change.

It was difficult for a country with population of 1.3 billion that heavily relies on cash to deal with demonetization. There were long queues at the ATMs for weeks. As for people who were holding huge amounts of cash (aka black money) started looking for commodities to hedge the risk of an economic slowdown; some bought gold, some bought silver.

Government was keeping a close eye on such people who were very conveniently converting their unaccounted cash for commodities or depositing them into multiple bank accounts.

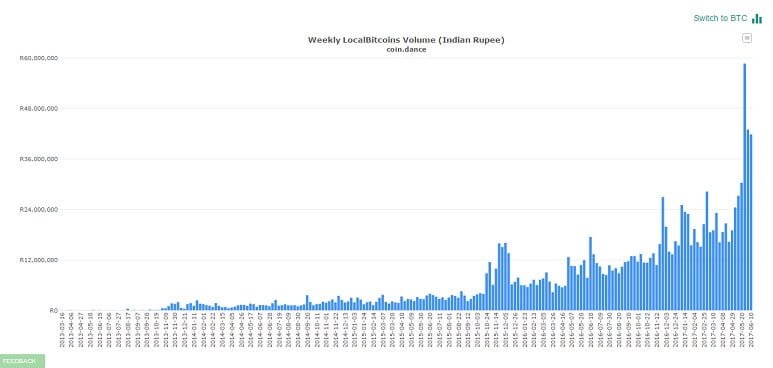

Out of the blue bitcoin price on Indian exchanges started to surge and weekly volumes of bitcoin trading nearly doubled. Prior to demonetization, all the three major exchanges in India were trading 700-800 bitcoins a day combined. At the time of writing this, Zebpay, the largest Indian bitcoin exchange alone does close to 4000 bitcoins trade every day. Even the volumes at localbitcoins.com are skyrocketing.

At one point the demand in India got so high that Indian bitcoin price was nowhere close to rest of the world’s. People were paying up to $300-$400 premium on every bitcoin transaction. Needless to say, online bitcoin exchanges were the happiest.

Founders of the Bitcoin Exchanges

Sandeep Goenka, the founder of Zebpay, said that post demonetization his exchange is now adding about 50,000 new users per month and the queries have gone up by 30 percent.

He said, “We hail the unprecedented move by PM Modi’s vision for a cash less and corruption free India. More people have started looking at Bitcoins and interest has surged. We are working hard so that Bitcoins and this technology can help fulfill the government’s dream.”

Unocoin, another India’s leading Bitcoin exchange said the average number of daily visitors to its website has spiked to 14,000, compared to roughly 4,000 prior to demonetization.

“We are seeing an increased demand for Bitcoin and India clearly has a shortage of supply, making the demand and lack of liquidity push up prices of Bitcoin as compared to global exchanges” said Mohit Kalra, CEO, Coinsecure.

Government Opinion

Time and again Indian government and the central bank (Reserve Bank of India) have cautioned Indian people against the virtual currencies emphasizing that they are not regulated by the RBI. But looking at the explosive growth and adoption bitcoin has seen since the beginning of 2017, it seems Indian government is looking to change their stance of virtual currencies.

Earlier this year, India’s Ministry of Finance (FinMin) established an interdisciplinary committee to study the legal framework surrounding virtual currencies. FinMin also sought public opinion on virtual currencies after stating that ‘the circulation of Virtual Currencies which are also known as Digital/CryptoCurrencies has been a cause of concern’.

Local reports hint that India is already in the process of regulating and taxing bitcoin and other cryptocurrencies. If India does come in favor of bitcoin, it will join likes of Japan, the only country that has legalized bitcoin as a payment method.

Demonetization brought a lot of good news for bitcoin adoption in India. Not only do people now know what bitcoin is, they are actively trading it with other cryptocurrencies and people are actually making money out of Bitcoins. The country still lags behind big time in terms of daily bitcoin volumes being traded when compared to major global exchanges like CEX.io. Just goes to show how big the market is that lies ahead for cryptocurrencies in the region.

To your Cryptocurrency success!